25/3/2020 – THIS OFFER IS NO LONGER VALID.

Another great free cash offer – this time from RateSetter. This offer sees you triple your initial deposit!

What is RateSetter?

RateSetter is a peer-to-peer investment platform who join people willing to loan money with people who wish to borrow it. With a normal loan you approach a bank or a lender and they decide whether to lend you the money. Your RateSetter account allows you to offer the money that is lent, without the need for a bank. By remaining online they keep their overheads down and so are able to reduce the costs and pass that reduction onto you, the lender, through higher interest payments.

Who are RateSetter?

They started in 2010 and are committed to being the safest and most liquid peer-to-peer lender in the UK. In 2014 they entered into the Australian market and in 2019 they won the Queen’s Award for Enterprise. RateSetter are a private company with over 200 employees and were the first globally to launch a provision fund.

Is My Money Safe With RateSetter?

As with all investments there is an element of risk. They are FCA regulated but that is not all. RateSetter created a ‘Provision Fund’ to act as a form of protection on poorly performing loans. For the past 9 years it has maintained a 100% record however they do explain that the Provision Fund isn’t a guarantee – if the funds were depleted completely then the investment would remain at risk.

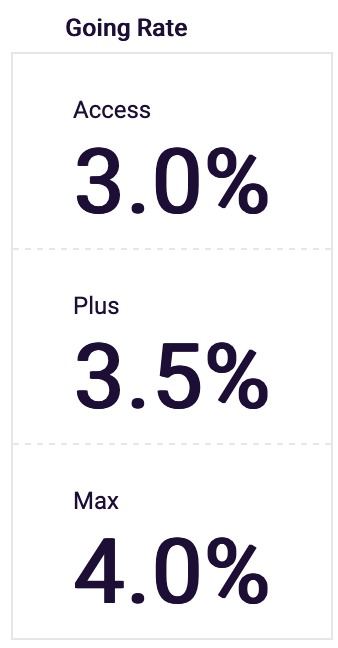

Current Interest Rates

At the time of writing this the current interest rates across the two accounts they offer are as follows.

These do change so check them before you sign up to make sure you are happy with them.

Joining Bonus

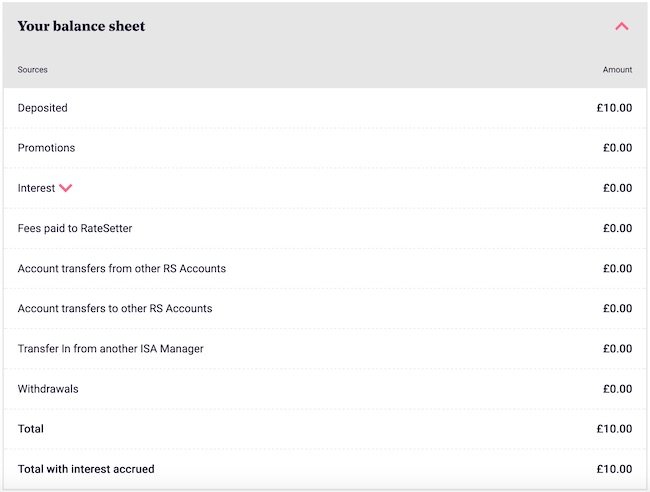

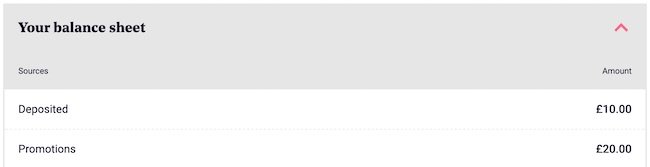

Historically, RateSetter has offered generous joining bonuses however you’ve needed to deposit £500 or £1000. Their current joining bonus now only requires you to deposit £10 to have £20 added to your account. That’s a 200% return on your cash – you wont get that from your bank!

Joining Steps

- Click this link – http://link.ratesetter.com

- Set up Account

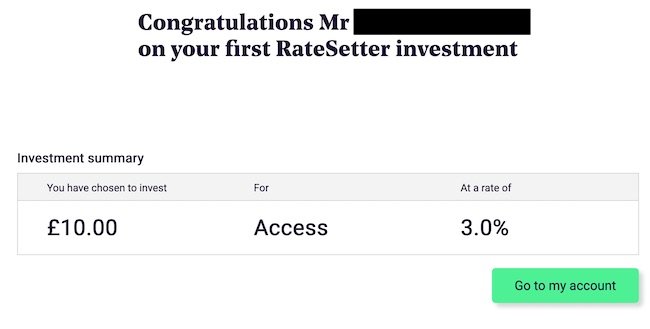

- Deposit £10 (I did this as a card payment)

- Once £10 is showing on account – choose whether to put it in the ‘Everyday Account’ or ‘ISA Account’ (I did the EveryDay Account)

- Wait until your £10 is matched

- Once your £10 is matched, you should get £20 added to your account (this might take a day or two – it can take up to 30 days).

- Choose whether to leave the money invested or withdraw

Withdrawing Money From RateSetter

It is your money so you can request to withdraw it when you want. As this money is invested in loans, RateSetter has to find someone to take on your loan before they can release the cash. They have outlined that on average this takes 24 hours. Depending on the product you choose to invest in, there may be fees to pay. One of the reasons I chose the Everyday Account is that there are no fees at all so when I withdraw my cash it is all mine.

The Reverend’s Final Thought

Who doesn’t like free cash? An easy £20 for you just for depositing and investing your £10. There is no reason why you can’t do the deposit, get the investment done, then withdraw all your cash. £10 in and £30 out. If you are after more free cash then check out this blog post that has all the free cash offers I’ve found and validated myself.

Its important that you do your own research with any scheme, regardless if you are in it for the long term or or short term. Make sure you are happy with it before handing over any cash. I have done this myself but it may not be right for you.

The referral notes now say £100 bonus for a minimum £1000 deposit after one year continuous investment. It would be a good return if it were risk-free but it isn’t. There is also £50 to the referrer given within 30 days. If you can refer someone else, or yourself, with a £1000 to spare, that is a better return.

Hi Timm,

I noticed this yesterday so added it as a big comment at the start of the post.

Although I know other people who have had no issue with getting the bonus for this (they have offered it before), I think it wouldn’t be right to expect people to put £1000 away with the hope of an extra £100 in a year’s time.

Thanks,

The Reverend

It needs deleting, I’ve loss my £10 for the next month. Did it on 24th cheers

Hi Dale Moore,

If you did it on the 24th, that was before I posted my blog post.

However if you did it on any dated before they changed to the new offer then you should contact them to make sure you get your bonus £20.

There is no reason, if you chose the everyday account, that you can’t withdraw any cash you’ve deposited before then. It takes on average 24 hours for a withdraw request to complete and the money is back in your account however RateSetter is advising there might be more of a delay at the moment but they are processing.

I blog about any deal I see and some are short-lived. I leave the posts up so that I know what I’ve blogged about but people can also see this offer was available at some point.

Thanks,

The Reverend

Just looked at email mine was set up on 25th 9pm,someone has matched my 10£ so can’t withdraw for the next 2weeks or so.

Hi Dale Moore,

On the 25th they were still running their bonus £20 offer so you should get that on your account.

There is no reason you can’t request your money back immediately. It takes on average 24 hours for funds to be released (they need to ‘pass’ you loan onto someone else). I’m not sure why you think you have to wait 2 weeks to withdraw it.

Thanks,

The Reverend

Thanks for this update. It seems Ratesetter have gone back to their earlier welcome offer of an extra £100 when you invest £1,000 and leave it there for a year. In case it helps to reassure anyone, I did that offer two years ago and got the £100 bonus paid into my account after 12 months without any issues. I also earned interest on my initial deposit, and continue to invest with RateSetter today. Obviously all investments do carry a risk of loss, but I cannot fault RateSetter based on my experiences to date.

Hi Nick,

thanks for your comment. I’m sure RateSetter are all above board however I do find them changing their referral scheme without any notifications via email a little strange.

As I’ve done the £10 + £20 joining offer I think I’m no longer eligible for the £1000 offer however I may look into further and do a separate blog post. It is a lot of money for some people to lock away for 12 months but the 10% ‘return’ for the first year would be very tempting.

Thanks,

The Reverend

No worries. I agree with you about the sudden change, but I guess with the virus outbreak and the massive demand they are experiencing right now, we should cut them a bit of slack. I suspect you are right to say that you will not be eligible for the £100 offer if you already benefited from the £20 one.

As regards the £1,000 offer, I would just mention that new investors should actually get a 13 to 14 percent return in their first year, as in addition to the £100 bonus they will of course be receiving interest at an annual rate of 3 to 4 percent currently. But yes, you do have to tie up your money for a year to get this. In an emergency you could access the money before that, but of course you would forfeit the bonus then.