What to do When your New Bank Account Requires you pay in £1000 a Month but you Don’t Earn That Much

This blog post has the longest title I’ve posted! Its for people who want to open a new bank account when they are offering a £150 bonus however there is a requirement to pay in £1000 a month. Not everyone earns enough to meet this threshold but that doesn’t mean they can’t take advantage of these excellent deals.

STEP 1. Online Banking for the new bank account and another bank account.

To do this easily its best to have two bank accounts that you can access online. The reason for this is that it makes the process simple as you can do it at home from the comfort of your own sofa. If you don’t have online banking or access to another bank account you can do this via the old school version of banking of withdrawing the cash from a cashpoint and paying it in over the counter.

STEP 2. Work Out How much you can afford to pay in.

It really is best if you can pay in at least £100 however I’ll show you how to do it on less. This works for any figure but requires more work the smaller the figure.

STEP 3. Pay in that amount

You only need to do this once.

STEP 4. Set up a standing order from your new bank account to your old bank account.

Self explanatory really! Set this up as a standing order

STEP 5. Set Up a standing order from your old bank account to your new bank account.

This is the 2nd standing order to return the cash to your new bank account account.

STEP 6. Make both sets of standing order re-occuring.

The number of re-occurrences depends on the amount you can initially deposit.

£100 = 3 payments a week (or every other day)

£200 = 2 payments a week (or every 5 days)

£300 = 1 payment a week (or every 7 days)

£500 = 2 payments a month (or every 14 days)

**NB – Do not forget you need to do these for BOTH accounts

STEP 7. Check your accounts and make sure the money transfers smoothly.

Its important that you make sure you don’t miss a payment as it may jeapodise your chances of getting the agreed cash bonus. Once you’ve got the cash bonus you can close the new account if you wish or keep it going. If your cash bonus is in the form of a guaranteed monthly interest/bonus then you might want to keep your accounts open.

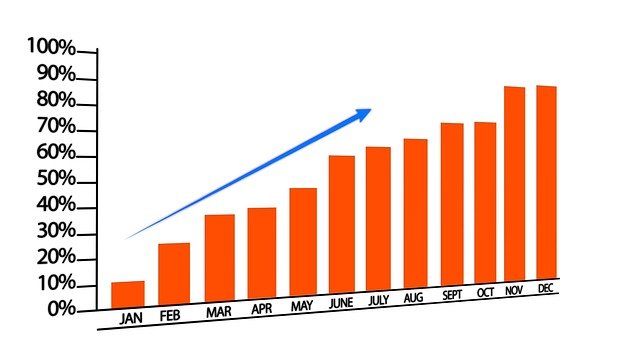

Monthly Bonus – Crazy Interest!

If you are getting a monthly bonus then your monthly interest can be crazy based on how much you initially deposit. For example, if you use the £100 deposit option you could get 12 x £5 which is £60! This works out as 60% and I very much doubt you could get this return with absolutely no risk.