According to The Sunday Times, Rishi Sunak has ordered Treasury and HMRC officials to prepare options for reducing the sales tax, which has stood at 20 per cent since January 2011.

The Independent is reporting that Rishi Sunak has ask his teams to look into whether they can lower the standard VAT rate. Currently it is 20% and the last change we had was in January 2011 where it changed from 17.5% to the 20% it has been for the last 9 years.

To help in the 2008 recession the standard VAT rate was dropped to 15% from 17.5%

Different VAT rates

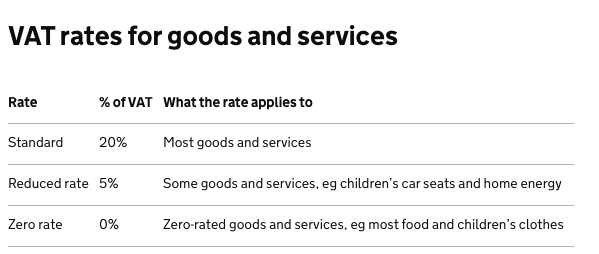

Above I’m talking about the ‘standard’ VAT rate. This is the rate people pay on ‘most’ goods and services. There are exceptions to this rate known as ‘reduced rate’ and ‘zero rate’.

Reduced Rate VAT is currently 5% and this covers ‘some’ goods and services. The government give an example of child car seats and home energy but it also includes items such as mobility aids for the elderly an renovating a dwelling that has been empty for at least 2 years.

Zero Rate is different to VAT exempt as it allows the supplier to claim back any tax against a product/service however exempt sales do not qualify for this. For the ‘person on the street’ you don’t need to worry about the distinction between the two.

Lower VAT Rate – Now What?

It hasn’t been confirmed there will be a VAT change but if there was, we don’t know what the rate will be until it is announced. There has been discussion that it could be 17% but there is no reason it couldn’t drop to 17.5% or even 15%. How will that affect you in real life? I’ve created a table to show you how this will alter the amount you pay.

As you can see from this table, if the rate drops to 17% then you’ll save about 30p when you spend a tenner. If you were looking to spend £50k getting a new kitchen fitted, then you would save about a grand and a half.

Will This Alter Your Spending Habits?

The idea behind a reduction in VAT is that it is to encourage the population to spend money. Although the treasury gets a smaller amount during the initial transaction, by having the money actually spent and not sitting in a saving account somewhere, that money can then continue to pass around the economy through wages into other sales where HMRC will collect more VAT, even at reduced rates.

In reality, if you had £50k sat in a savings account, would you spending it on a new kitchen or an extension knowing you could save, at most, £2500 (if it is a drop to 15%)? Or would you delay the remodeling of your house and keep your £50k as savings in case you were made redundant?

Of course, if you needed to buy a new car, or a new kitchen or whatever, then the saving is considerable and could soften the blow and make you feel better spending the cash – that’s probably how a VAT reduction would be sold – You are helping the economy so we will help you.

The Reverend’s Final Thought

Anything to encourage spending will help the economy. Will it make the difference needed, I don’t know. I do know that the problem isn’t the ‘person on the street’ keeping some savings in the bank. The problem is the people and businesses who keep their money off-shore, paying no (or reduced tax) in the UK. HMRC should do more to stop them being able to with-hold tax from the UK when the money is spent in the UK. Around the time the VAT rate rose to 20%, a secret deal was made between Vodafone and HMRC regarding their outstanding £7 BILLION tax bill. Try not paying your taxes until they reach £7billion and see how that goes (*hint – Don’t!).

So if the VAT rate is changed, it may or may not change you spending habits but if the rate is lower you will have additional money in your pocket. How you choose to spend this is up to you.

And Yes, I did buy Snoop Doggy Dog’s album, DoggyStyle in Vinyl. 😀

If you are looking for ways to get some free money then check out my Free Money in 2020 links

I was quite excited about this when I first heard the whispers that a VAT cut may be impending. I started thinking about that new MacBook I had my eyes on. Then it was announced and you learn the small selection of things this cut applies to… Considering I still think the pandemic is in full swing and it’s too dangerous, I won’t be using these sorts of outlets, but hopefully it’ll help those that do and maybe give the business in the hospitality & travel industries a little boost because I’m sure they’re in much need of it. Great thoughts on this topic!

Hi Caz / InvisiblyMe,

There was talk about the £500 voucher per person – that would have helped to get money moving but instead they are wanting people to go to restaurants and ‘events’.

This is not the correct way to do it.

🙁

The Reverend