This is a collaborative post

Getting control of your finances is vital if you want to finish your journey out of debt. The first thing you need to do is write down all your debt so you know what you owe and where. The next thing you need to look at is how you can pay down your debt in a way that is suitable to your circumstances. If you are like me, then you probably have a bit of money on store cards or credit cards.

Relationship With Debt and Credit Cards

In the UK we have a close relationship with borrowing money, esepcially on our credit cards. The BBC highlighted that we were carrying £120billion of debt across multiple types of agreements and credit cards. This worked out as the median family have £4,500 of debt. It is important to remember that you are not alone when it comes to borrowing and that being in debt is a state many family share. What you can do is look to see how you can improve your relationship with that debt.

Facing Up to your Debt

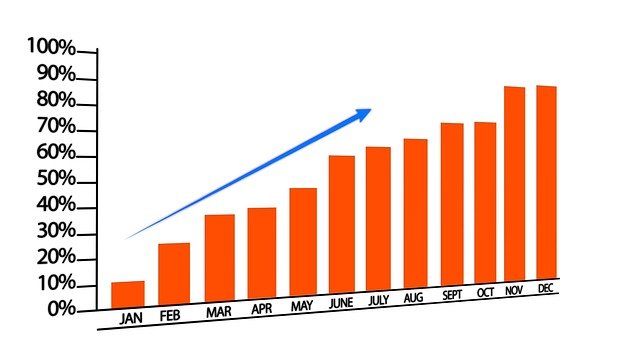

Once you have written down all your debts you can then look at what your options are to reduce them down. If you have taken a loan out then you will find that the payment amount may be fixed and the loan might not allow additional payments against it. If you have credit cards then you can start to compare what happens to your debt (and interest) if you make additional payments. An easy way to do this is to use a calculator to do the maths for you where you can quickly see how an extra £5 or £10 a month against a credit card can pay off your outstanding balance faster.

As an example, if you had £2000 on your credit card and was paying £50 a month against it, only £16 would go to paying off the outstanding £2000, the remaining £34 would be just in interest. You would expect this to take 5 years to clear the £2k balance. Add £10 to your monthly payment and it would take 3 years and 10 months to pay it off, a whole one year and two months earlier! More importantly you’d be saving over £300 just by paying off an extra ten pounds each month.

Snowball versus Avalanche

Two popular ways of paying off debt are the snowball or avalanche method. With the ‘snowball’ method you keep all your payments the same EXCEPT for the smallest outstanding balance which you make the largest payments against until it is paid off. Once this is paid off you then pay what you were paying against the smallest balance to the next smallest balance. You keep this going until all your debt is paid off. It is called the ‘snowball’ method as it imagines you are rolling a snowballs down a hill and it gets bigger as it gets down hill. Your payment against your debt is the ‘snowball’.

The Avalanche method is the same as the snowball except your pay against the debt with the highest APR as this is the debt that is costing you the most. You then work down through the APR levels until all your debt is paid off. Once again, an online calculator can help do the calculations to work out what each different type of debt pay-down will do.

Some people enjoy seeing the outstanding debts (in number) reduce and so the snowball is more appropriate to them. Other people like knowing they are paying down the most expensive debt first and the Avalanche method would fit that requirement. Either way, make sure you understand the pros and cons of each.

How to Increase Your Income

Its easy to talk about paying off debt but it does require money to actually do. Finances have been hit during the old Pando and it can feel like there is no possible way to earn extra money. I have created a blog post about how to make a passive income and also how to protect your sellers account if you sell on eBay.

If you want to go to the next level to increase your income then there are plenty of apps that will help you pick up casual work like photographing adverts or doing stock-checks in supermarkets. Remember the reason for doing this and make sure that you use your extra income to pay down the debts you want to remove.

The Reverend’s Final Thought

Unlike other people, debt is not a ‘dirty word’. In today’s society it can be seen as a necessary evil – you’d struggle to buy a house for cash instead of a mortgage. Hopefully after reading this blog post you will feel you are able to understand your debt more and work out a plan for clearing it down. You are not debt and your debt is not you. If you feel like your debt is getting out of hand then I recommend you read this page of The Debt Camel website https://debtcamel.co.uk/more-information/where-to-get-help/ as they have some great advice on where to start in getting help from the right people.